Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

At the beginning of 2020, prior to the pandemic, we surveyed independent automotive repair shops to get insight into what they thought their biggest challenges would be for 2020, for both their shop and their technicians. That research can be found here: Challenges for Independent Repair Shops and Technicians in 2020.

With the unexpected change in business due to the pandemic, we spoke to independent auto repair shops again to see if and how their perspective changed.

About this research: Between May 4th and May 29th, 2020, IMR interviewed 500 independent repair shops, nationally representative by location in the U.S., to gain insights into the challenges repair shops and technicians face in 2020.

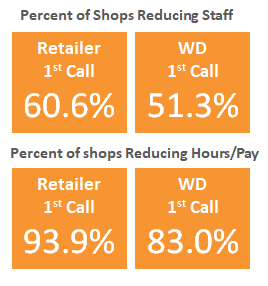

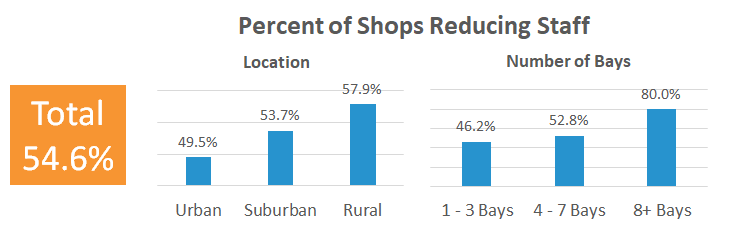

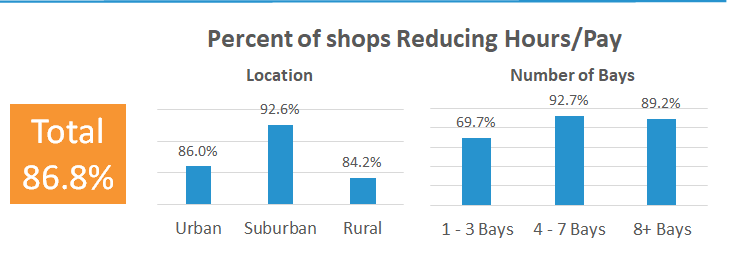

In order to add context to their challenges, it’s important to understand how the pandemic has effected independent repair shops and their staff. The vast majority of shops (84%) had a decrease in revenue (84%) as well as staff reductions (54.6%) and pay reductions (86.8%).

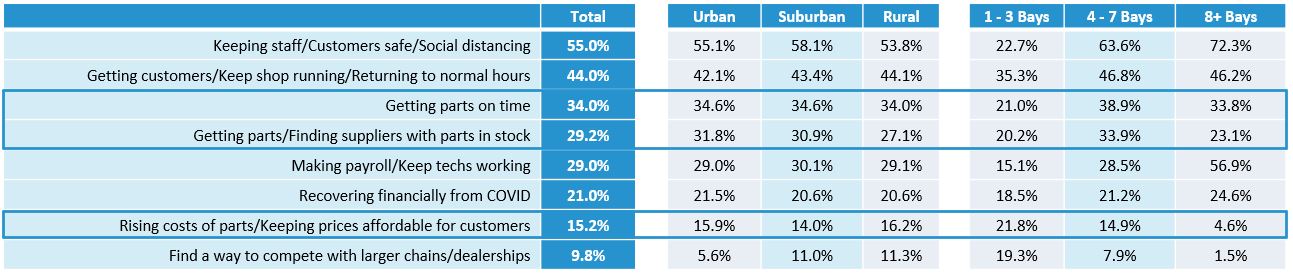

What do you believe are the top challenges your shop will face for the remainder of 2020?

Not surprisingly, independent automotive repair shops are concerned about social distancing, staying in business, getting back to normal hours and, generally, recovering from COVID-19.

However, when asked about what shops believe their top challenges are for the remainder of the year, they believe getting parts on time, finding suppliers with parts in stock, dealing with rising parts costs and, in turn, adjusting to keep their prices affordable will be challenges they’ll need to mitigate for the remainder of 2020.

In January, when these questions were asked, shops were primarily concerned about keeping up advances in diagnostics (31.6%), finding quality techs (29.2%), having funds for advertising (26%), increasing parts prices (16.6%) and affording diagnostic tools (15.6%).

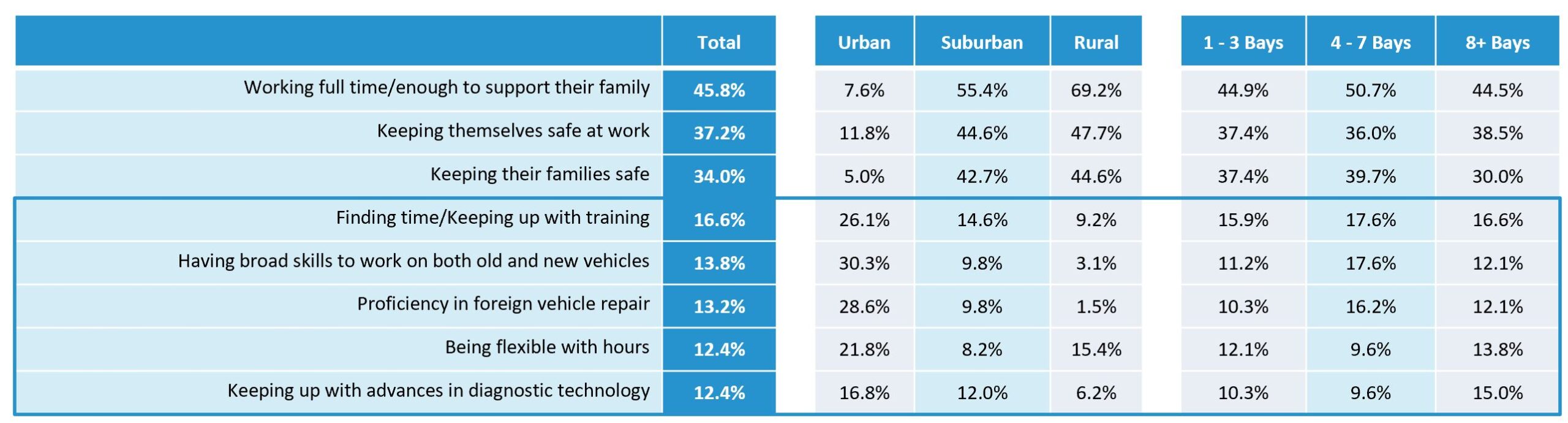

What do you believe are the top challenges technicians will face for the remainder of 2020?

When it comes to the technicians working in the shop, working ‘full time’ to support their family, keeping themselves safe at work and keeping their family safe from COVID-19 are the primary concerns.

Many of the subsequent concerns that were named haven’t changed much, other than the order/frequency of being mentioned, from when this question was asked earlier in 2020.

In January, finding time for training was the number one response at 42.6%, now in May 16.6%, followed by staying on top of vehicle technology advances (31.1%), now 8.0%, and keeping up with advances in diagnostic technology (30.9%), now 12.4%.

Segment: Shop’s 1st Call Supplier is a Retailer vs. a Warehouse Distributor

When segmenting by whether the shop’s first call is either an auto parts retailer or warehouse distributor, differences appear when comparing the relative magnitude of certain named challenges between those shops.

What do you believe are the top challenges your shop will face for the remainder of 2020?

Learn More About In-Depth Consumer Demographics

Interested in automotive market research?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.If you enjoyed this article, please check out some additional posts

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Challenges for Independent Repair Shops and Technicians in 2020

Cell Phone Usage in Bays at Independent Repair Shops

The Hispanic DIY Auto Maintenance & Repair Consumer

Consumers Delaying Vehicle Routine Maintenance

Part Delivery Times at Independent Automotive Repair Shops

Independent Auto Repair Shop Private Label/Store Brand Purchasing

Independent Auto Repair Shop’s Competitor Perceptions & Differentiation

Independent Auto Repair Shop’s Biggest Competitors

How Repair Shops are Investing in their Future

View IMR’s Automotive Research Reports & Infographics

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Automotive Repair Shops Install-It-For-Me (IIFM) Trends

Disruption in Auto Parts Availability Affecting Shop Purchasing Behavior

Insights Into the Hispanic DIY Automotive Maintenance & Repair Consumer Profile

Challenges for Independent Repair Shops and Technicians in 2020

Automotive Repair Shops Reveal Their Biggest Competitors

Auto Part Delivery Times at Independent Automotive Repair Shops

The Store-Brand Automotive Part Market

COVID-19 Challenges, Independent repair shops, Repair shop challenges, Repair shops keeping customers safe, Repair shops reducing hours and pay, Repair shops reducing staff, Technician challenges