2025 Repair Shop Challenges

As the automotive aftermarket navigates an evolving landscape, repair shops are bracing for significant challenges in 2025 and beyond. A recent IMR study revealed that concerns around part pricing and supply chain disruptions are at the forefront of shop owners’ minds. The findings underscore the critical issues impacting their operations and profitability.

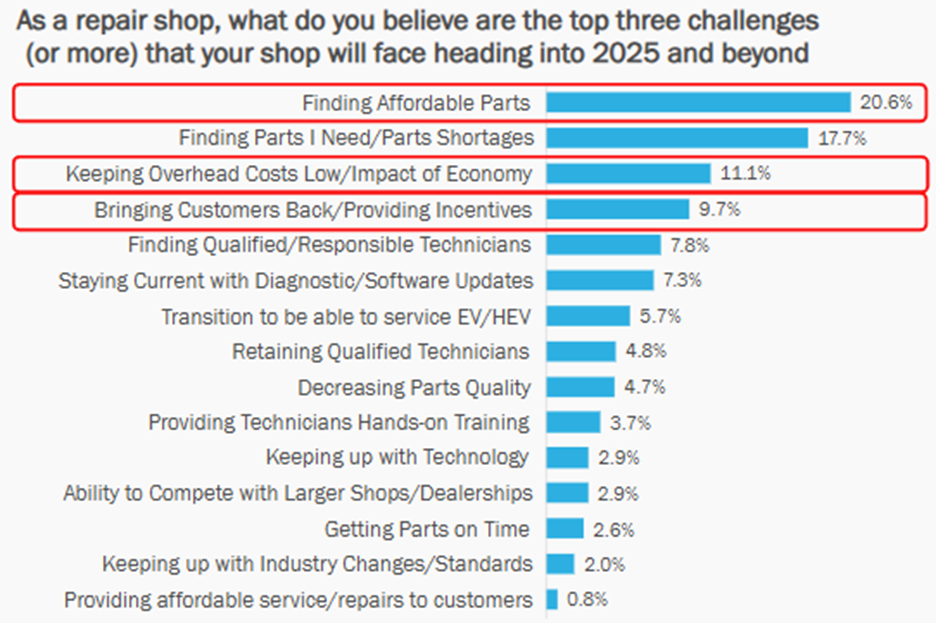

When asked to identify the top challenges they expect to face in the coming years, repair shops overwhelmingly pointed to issues tied to part pricing. The leading concern, cited by 20.6% of respondents, is the difficulty in finding affordable parts. This reflects broader economic pressures, including inflation and rising costs, which have driven up prices for essential components.

Closely related, 17.7% of shops highlighted keeping overhead costs low amidst part shortages as a major hurdle. Supply chain disruptions, exacerbated by global events and proposed tariffs on imported parts have made it harder for shops to secure parts at reasonable prices. Additionally, 11.1% of respondents expressed worry about bringing customers back or providing incentives in the face of higher repair costs, which often stem from elevated part prices passed on to consumers.

Beyond pricing, shops are grappling with workforce-related issues. The survey identified finding qualified and responsible technicians as a top concern for 7.8% of shops, while 4.8% noted the challenge of staying current with diagnostic and software updates to service electric and hybrid vehicles (EV/HEV). Another 4.1% pointed to retaining qualified technicians, underscoring the competitive labor market and the difficulty of maintaining a skilled workforce amid technological advancements.

Decreasing parts quality was noted by 4.7% of respondents, raising questions about reliability and long-term customer satisfaction. Meanwhile, 3.7% of shops cited the need for providing technicians with hands-on training to keep up with evolving vehicle technologies, such as advanced driver-assistance systems (ADAS).

Shops also face competitive pressures, with 2.9% mentioning the ability to compete with larger shops or dealerships, which often have greater resources and access to parts. Additionally, 2.6% highlighted the challenge of getting parts on time, a direct consequence of supply chain bottlenecks. Keeping up with industry changes and standards was a concern for 2.0% of respondents, while 0.8% worried about providing affordable service and repairs to customers in an increasingly cost-sensitive market.

Three of the top four concerns—finding affordable parts, managing overhead amidst shortages, and incentivizing customer return—directly tie to cost pressures. These issues are compounded by broader trends, such as the need to adapt to new vehicle technologies and retain skilled technicians in a competitive labor market.

Interested in Independent Auto Repair Shop Private Label/Store Brand Parts Purchasing Data?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.

Learn More About Automotive Repair Shop Market Research

If you enjoyed this article, please check out some additional posts

Impact of Battery Electric Vehicle and Hybrid Electric Vehicle Repair and Service at Independent Repair Shops (Update 2022)

Current and Future Challenges for Independent Repair Shops – 2022

Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn