Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

Between May 3rd and June 30th, 2021, IMR interviewed 1,000 independent automotive repair shops, nationally representative by location in the U.S., to get insight into their service exposure to Battery Electric Vehicle (BEV) and Hybrid Electric Vehicle (HEV) vehicles. Additionally, the research gained insight into the shop’s investment in tools/equipment and training for BEVs/HEVs, whether they market these service capabilities and their view of when they believe BEVs and HEVs will impact their business amongst other insights.

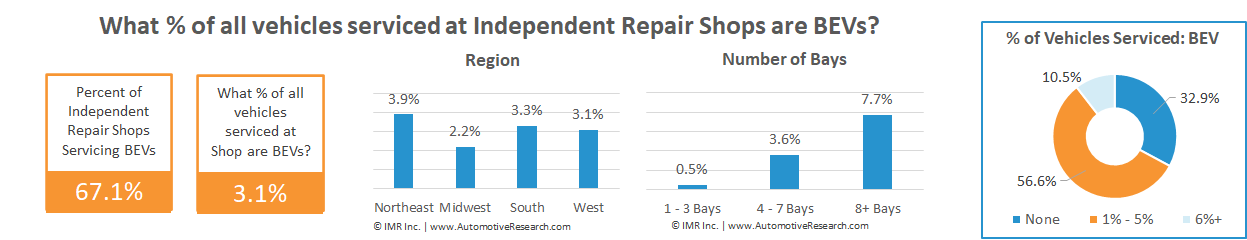

67% of independent repair shops indicate a portion of their business is from servicing battery electric vehicles. On average, 3.1% (or 3 of every 100 vehicles serviced) are BEVs. Heavy BEV populated states, particularly California, and East coast shops tend to have higher service percentages while the Midwest shops have lower percentages.

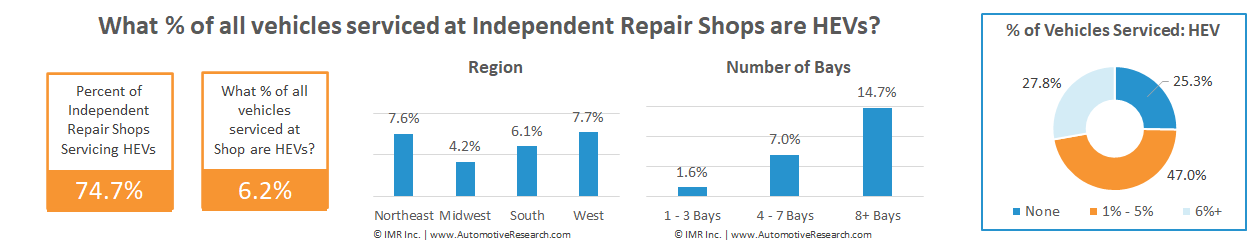

75% of independent repair shops indicate a portion of their business is from servicing hybrid electric vehicles. On average, 6.2% are HEVs. BEVs and HEVs account for less business for 1 – 3 bay shops (0.5% BEV; 1.6% HEV) versus larger 8+ bay shops (9.2% BEV; 14.7% HEV). Shops located in the West (7.7%) have nearly double the percentage of business from HEVs than shops located in the Midwest (4.2%).

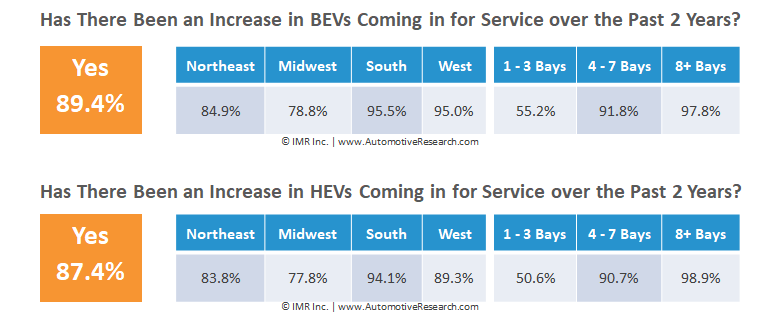

Of the independent repair shops that service BEVs, over the past two years 89.4% have seen an increase in the number of those vehicles coming to their shop for service. Similarly, of shops that service HEVs, over the past two years, 87.4% have seen an increase in the number of those vehicles coming to their shop for service.

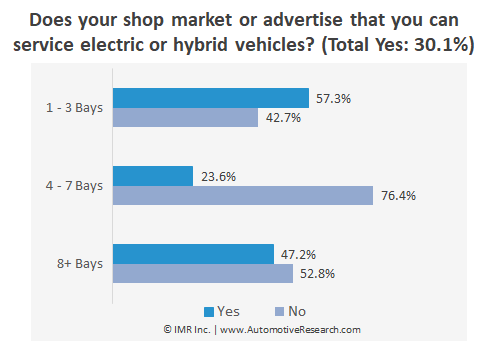

While these shops have seen increases in these vehicles coming in for service and repair, 69.9% do not actively market or advertise that their shop is specifically capable of servicing BEVs and HEVs. However, shops with 1 to 3 bays tend to market that service capability more (57.3%) than their larger competitors even though they do not see as much of their business from those vehicles.

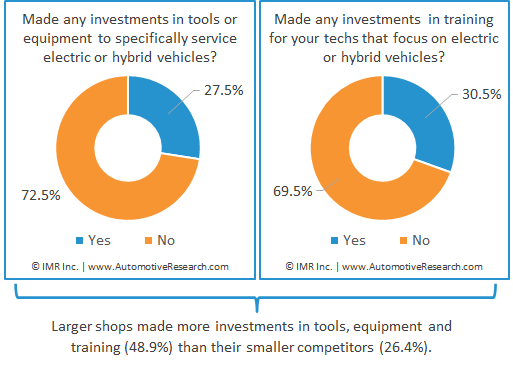

Amongst all independent repair shops, 27.5% have invested in tools/equipment to service BEVs/HEVs and 30.5% have invested in BEV/HEV training for their technicians.

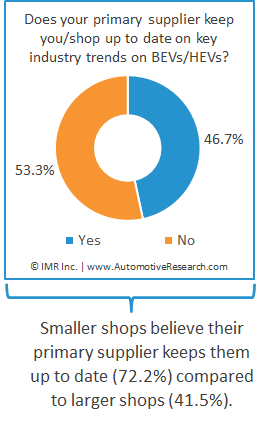

When it comes to keeping up to date on industry trends on BEVs and HEVs, 46.7% of shops say that their primary supplier keeps them up to date.

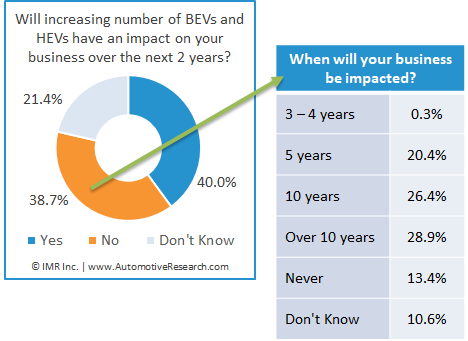

Forty percent of shops believe the increasing number of EVs and HEVs on the road will impact their business over the next two years; 38.7% do not and 21.4% don’t know. Of the 38.7% that do not believe the increasing number of BEVs and HEVs on the road will impact their business in the next two years, 55.1% believe it’ll take 10 years or longer to see an impact; 13.4% believe it will never impact their business.

Learn More About In-Depth Consumer Demographics

Interested in automotive market research?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.If you enjoyed this article, please check out some additional posts

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Challenges for Independent Repair Shops and Technicians in 2020

Cell Phone Usage in Bays at Independent Repair Shops

The Hispanic DIY Auto Maintenance & Repair Consumer