Current Challenges for Independent Automotive Repair Shops – 2023

At the beginning of 2023 IMR surveyed independent automotive repair shops to get insight into what they believe their biggest challenges will be in 2023.

Given the changing market dynamics over the past few years, once again, the challenges they expect to face this year are different than 2022 and wholly different from 2021.

About this research: Between January 1st and January 31st, 2023 IMR interviewed 500 independent automotive repair shops, nationally representative by location in the U.S., to gain insights into the challenges repair shops expect to face in 2023 and what future challenges they see on the horizon.

For reference, in 2019, prior to the pandemic, independent repair shops listed their biggest challenges as Finding Time for Hands-on Technician Training (42.6%), Staying up to Date with Advances in Diagnostics (31.6%), Keeping up with Advances in Vehicle Technology (31.1%) and Finding Good, Knowledgeable and Motivated Technicians (29.2%).

In 2022, the challenges shops expected to face were Finding Parts I need/Parts Shortages (35.8%), Bringing Customers Back/Providing Incentives (31.8%), Finding Affordable Parts (29.4%) and Getting Parts on Time (27%).

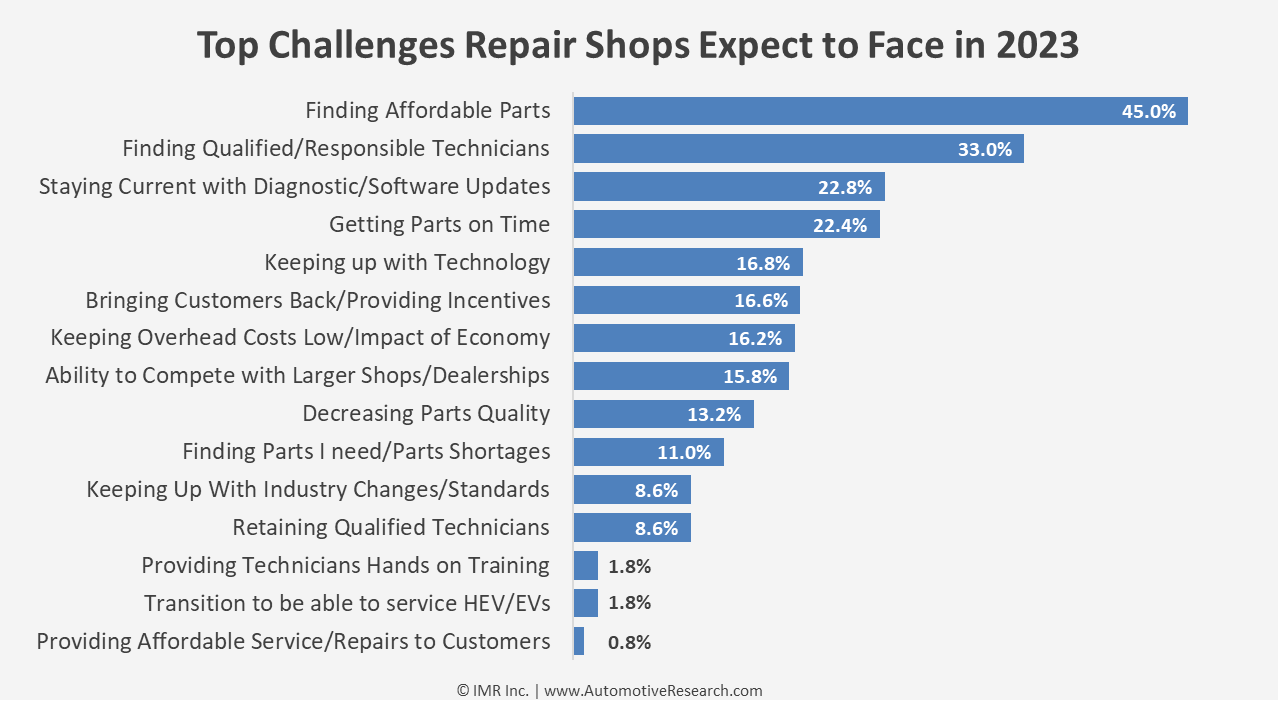

Now, in 2023, three of the top five shop challenges are similar to those expected in 2019. However, Finding Affordable Parts (45%) which is now ranked as the number one expected challenge, and Getting Parts on Time (22.4%) make the top five.

Compared to 2022, the challenges shops expect to face in 2023 are only similar in that Finding Affordable Parts (45%) and Getting Parts on Time (22.4%) remain significant concerns while Finding Qualified/Responsible Technicians (33%), Staying Current with Diagnostic/Software Updates (22.8%) have become increasingly cited challenges.

While in total, the challenges automotive repair shops expect to face mention finding affordable parts, finding qualified/responsible technicians, staying current with diagnostic/software updates and getting parts on time, when we look at the results by bay size it shows that the different size shops consider some challenges to be more pressing than others.

For example, the number one ranked issue for shops with 1 to 3 bays is finding qualified/responsible technicians with finding affordable parts ranked second while shops with 4+ bays consider finding affordable parts their number one challenge.

On average, shops with 1 to 3 bays mentioned 2.1 challenges, shops with 4 to 7 bays mentioned 2.3 challenges and shops with 8+ bays mentioned 3.3 challenges.

Interested in additional Independent Automotive Repair Shop Data?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.

Read IMR’s U.S. Household Perception of the Trades Study

If you enjoyed this article, please check out some additional posts

IMR’s ‘U.S. Household Perception of the Trades’ Report

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops (2022 Update)

Impact of Battery Electric Vehicle and Hybrid Electric Vehicle Repair and Service at Independent Repair Shops (2022 Update)

Current and Future Challenges for Independent Repair Shops – 2022

Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)