IMR Survey: Tariffs Impact Repair Shops in 2025

IMR, a leader in automotive aftermarket research, surveyed 500 general repair shops in April 2025 to assess the effects of recent tariffs on their operations, pricing strategies, and supply chains. The results reveal a mixed landscape with significant size-based variations.

Business Operations Affected by Tariffs

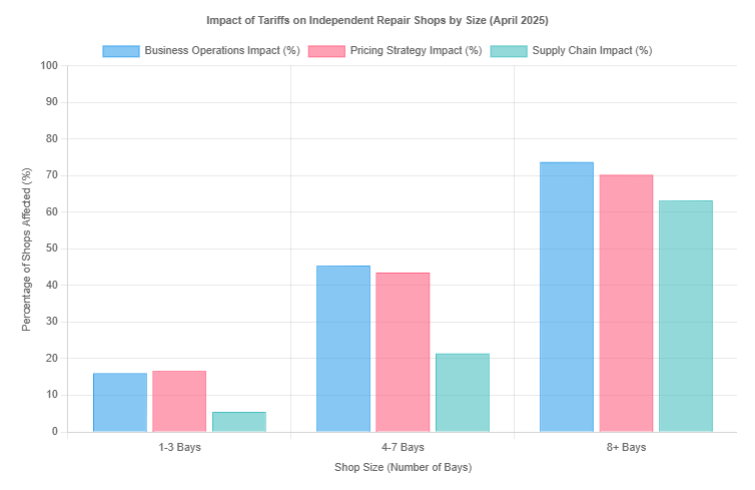

Overall, 38.6% of shops reported some impact from tariffs, with the remainder (59.3%) experiencing no effect. Cost increases were the most cited issue, affecting 38.0% of shops, particularly those with 8+ bays (73.7%). Larger shops (4-7 bays) also noted cost pressures (45.4%), while smaller shops (1-3 bays) reported a lower rate (16.0%). Other changes impacted 1.0% of shops, with no significant issues like part unavailability or lower customer demand noted (all below 1.0%).

Pricing Strategies Shift Due to Tariffs

Tariffs influenced pricing for 40.7% of shops, with 36.8% raising product prices due to cost increases—most prevalent among 8+ bay shops (70.2%). Larger shops (4-7 bays) followed at 43.5%, while smaller shops (1-3 bays) saw 16.6%. A smaller 2.6% absorbed costs to maintain prices, and 0.4% lost customers due to price changes, with no influence reported by 59.1% of shops overall.

Supply Chain Challenges Emerge

Supply chain effects were reported by 26.0% of shops, with higher shipping costs impacting 20.4%—a notable 63.2% among 8+ bay shops, 21.4% for 4-7 bays, and 5.5% for 1-3 bays. Part shortages affected 2.4%, and shifts in customer purchasing behavior impacted 3.1%, with larger shops (4-7 bays) feeling these effects more (4.2% and 4.3%, respectively). The majority (73.0%) reported no supply chain issues, with smaller shops (1-3 bays) at 87.8%.

Regional and Size Insights

The data highlights disparities by shop size: larger shops (8+ bays) were hit hardest, with 73.7% facing operational costs, 70.2% adjusting prices, and 63.2% dealing with shipping costs. Smaller shops (1-3 bays) showed resilience, with 81.2% and 87.8% reporting no impact on operations and supply chains, respectively. These findings suggest tariffs may disproportionately challenge larger operations with greater part volumes. Alternatively, larger shops may simply be more aware of pricing impacts based on volume and reporting practices.

While tariffs have not universally disrupted independent repair shops, cost increases and pricing adjustments are significant concerns, especially for larger facilities. IMR remains committed to tracking these evolving tariff trends to provide timely insights in an ever-shifting landscape.

Interested in Independent Auto Repair Shop Private Label/Store Brand Parts Purchasing Data?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.

Learn More About Automotive Repair Shop Market Research

If you enjoyed this article, please check out some additional posts

Impact of Battery Electric Vehicle and Hybrid Electric Vehicle Repair and Service at Independent Repair Shops (Update 2022)

Current and Future Challenges for Independent Repair Shops – 2022

Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn